March 16, 2011

- in Uncategorized by schooloftrade

Why did crude oil futures drop? I almost missed this trade!

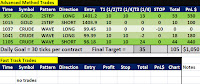

Click Here To Review Our Automated Trading Results From This Morning

830AM est

– Housing starts tumble lower than than expected (USD bearish)

– Producer Price Index (costs of producing goods and services) rises sharply. (USD bearish)

– We see two news events come out USD bearish, lets watch the dollar and see how it reacts.

– We look at the 13range DX chart and we see the short term bearish price channel, which gives us more clues today

– Dollar drops = we want to buy

845am est

– The markets are very slow for a wacky Wednesday

– Its OPEX so lets be careful

– The best way to help ourselves during slow times is to do our homework

– Lets plan how we will trade the crude oil

– I want to sell the highs of the price channel around 99.00

– We need to clear through the major support on the 34range chart, and then make sure we get below the next swing low for this short.

– Looking to sell the highs below 98.27 on crude oil

– Momentum and our other rules still apply

– What if price rises?

– We need to clear through overhead resistance to buy on crude oil

– Im looking to buy a pullback once we break new highs above 99.38

– We don’t want to buy at the OPEN from Tuesday, too sloppy, so wait for the new highs and then buy the pullback

910am est

– We appear to have a very unfriendly market on crude oil this morning

– Looking at the recent passed on the CL, this morning’s personality is very sluggish, and looks like it simply is not in the mood for big moves this morning

925am est

– The dollar index breaks its bearish price channel on the 13range chart

– We now have the dollar rising up to the HOD

– We see enough room for the DX to rise enough to give us some selling opportunities on the markets we trade

– We still see very slow speed

935am est

– Looking at the gold futures at the US open

– We see the short term price channel in pink trend lines, and we want to buy the lows of this channel

– We also see the BIG picture shows us we’re in the middle of the range from Tuesday (inside day)

– Inside days = more challenging b/c the traders we assume are looking for more information.

– We see overhead resistance at 1403.9 so look to beware trading around that level

– Sell the highs of 1403.9, but also look to buy a pullback if we break new highs

940am est

– USD makes new highs pushing thru resistance

– We need to see sellers to get short with the crude, but not the gold

1030am est

– We see crude oil has been very slow into the news

– Now we see inventories drop, and we get information that 15% of the PPI this morning was from rising costs of OIL

– The initial reaction from the market is BUYERS

– Lets wait to 835am and see where the BIG MONEY takes it

– We’ve learned that lesson before….little patience will save you from a loss.

– Wait for the price to calm down, make your plan of attack, and then execute it.

1045am est

– We’ve had a few decent trades today, but the markets are screaming at us right now to be careful

– We see crude oil inventories moved a little, but now the speed is slow again and we sit on our hands

– The biggest concern is the lack of VOLUME today

– With wacky Wednesday, we have these unexpected bursts of volume, and without any consistent volume, its making us lose confidence in WHEN the market will move for us.

1115am est

– We just saw the US equity markets tumble

– Crude oil tumbles off the highs

– All based on speculation that we have a danger with the Nuclear Power in Japan

– Very strange to see the price DROP when this news hit the wire

– Why didn’t this raise more concerns over crude supply?

– Because of that I was looking to BUY at support after the big drop we would see a big pop

– We didn’t have enough to buy the lows, and we kept seeing more sellers

– We decided to trade the price action, not what we think we know, and we got short with the wave on 13range on crude oil

– We needed a final target, and we used the AB=CD pattern to find the final target.