- in Uncategorized by schooloftrade

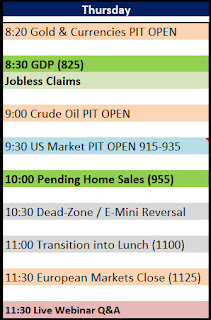

Traders expecting optimistic GDP and Praying for better Jobless Claims data to get this market moving early

– euro currency futures are trading at their highs with the dollar index at the lows, and this is a perfect scenario to sell the highs on the euro if the dollar index starts to rise off support. Trading at the highs of the price channel we know its going to tough to buy at the highs, so look for deep pullbacks such as 21range wave patterns to get long, and remember the easier trades will likely come later as the dollar index comes up off support allowing us to sell these highs on the Euro.

– Gold futures trading in a bull price channel in the middle and we have a few options. If price rises we sell the price channel highs as resistance, and be very careful trying to buy at the highs. Use 21range and 34range wave patterns to buy deep pullback if the dollar index keeps dropping and we keep rising. If the price drops we have the buy zone at the price channel lows which makes for a great buying opportunity at the lows. If price moves below the price channel lows we will buy support until we break below the PLOD and then we look for the fake-out breakout first then followed by selling retracements with new lower-lows below PLOD. Selling even more below the 1694.0 the previous price wedge highs.

– crude oil futures are inside the range from Wednesday, so we want to buy the lows and sell the highs. We have a price wedge so sell the highs, buy the lows, and avoid the middle of the price wedge. If price rises I’m selling and if price falls I’m buying. If we get above the 94.65 I will look for fake-out breakout first and then with strong buyers I will buy a pullback. If we get below 90.00 PLOD I will look for fake-out breakout first and then sell retracement down into the zone below us and then look for price to move lower from there to sell again.

Russell Futures

—————————————————————————————

I’m always improving this prep, I appreciate your feedback, please post it here!