August 23, 2011

- in Uncategorized by schooloftrade

Price Wedge Fails; We hit our daily goal trading crude oil and gold

CAD News @ 830am, crude oil is a large export from Canada, so major news in CAD will affect the prices of crude oil.

815am est

Crude Oil Futures:

– Trading in a bull price channel

– Outside day (above PHOD)

– Inside a price wedge

– Strong bull channel on the 89range chart

Our plan of attack on crude oil this morning will be to wait patiently for better price action, as its still pretty slow at 820am est this morning.

We have an outside day above the PHOD so buying pullbacks with new higher highs.

We also know about the price wedge, so do not trade long into the highs of the wedge around 86.47

We know that if price drops the PHOD at 85.18 we then go INSIDE DAY and then we expect the sellers to take charge and we want to be selling.

Inside day / outside day issue will be on our minds all morning today if we can’t break highs or new lows.

Bull channel reminds us to be buying as price falls at the major levels of support on the 89range and 34range charts.

Buy the lows and sell the highs of the price wedge, especially if we are below the PHOD, Inside day, so we expect the highs and lows to hold.

830am est

Gold Futures:

– Bull Price Channel 89range

– Price Wedge 89range

– Sideways Range 89r

– Inside day (below the PHOD, above PLOD)

– Very sloppy and consolidated inside the price wedge

– New all-time highs were made on Monday, so this price action is emotional.

– Bear Channel on the 13range chart

Our plan of attack for trading gold is going to be simple.

We’re at the lows of the major bull channel, so looking to buy the lows of the bull channel, and buying the major support below the lows of the channel. Support at 73.0 will be great buying opportunity.

We see the bear channel and the price wedge, so we want to buy the lows and sell the highs of the price wedge.

Inside day tells us to beware the fake-out breakout and to sell the highs as price rises and buy the lows as price falls.

Bear channel tells me to sell retracements with new lower lows, but only AFTER ive looked to buy those lows.

We also cant trade into the lows of the wedge, so watch out for the major levels of support below.

If we break below 73.00 we can then sell aggressively down to 60.5, the next major support.

73.00 is a major line in the sand. Above it and the bull channel is holding, and below it the sellers have won the battle (not the war) and prices should be dropping down to the next major support.

Euro Futures:

– Price Wedge (major) from 89range

– Major Resistance overhead which we’ve used before to sell at the highs

– BMT is the price magnet, right in the middle of the range

– Outside day above 4430, inside day below 4430

– Price Wedge on the 34range which is much narrower

Our plan of attack on euro is quite simple this morning.

We are outside day, but trading in a price wedge, so we cant do anything to the highs until we break above the 4512 and break through the overhead resistance.

If we break to new highs we need to be VERY careful about buying long. We’ve seen a great tendency on the euro to fail at the highs, so look for trading the FAILURE PATTERNS.

I want to be selling as price rises at the next level of resistance.

If we break below the PHOD 4430 we then turn to INSIDE DAY, which means the sellers have collectively FAILED to push new highs, finding new buyers, and new demand, and now that failure will result in falling prices below the 4430.

Selling 4430 will be a high % trade, and then look to sell again below 4400 which is also the major wedge highs on the 89range chart.

930am est

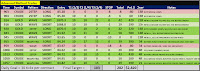

We took the early morning loss on crude oil trying to buy the lows of the wedge, and we then used that as a BIG CLUE that the sellers were stronger than the buyers and that price would be falling quite soon.

We had an easy 21range wave short which allowed entry with the 4range chart to take advantage of that clue we got at 845am today.

Gold made new lows below 73.0 line in the sand we spoke about at 800am today and we sold 2 retracements.

The 2nd retracement failed at the new lows, so we then decided to BUY THE FAILURE at the lows of the channel.

1005am est

The market personality is changing, so beware the summertime low volume may start creeping in, however, we should see some more opportunity today.

· Crude made new lows and we sold retracements.

· Gold made new lower lows and we sold retracements.

News at 1000am Manufacturing Index from Richmond VA was TWICE as low as expected.

This new should be CRUDE BEARISH, so let’s keep an eye on selling for crude oil.

1025am est

Crude Oil Futures have been very good to us today, new lower lows and then the failure at those lows made from some easy patterns and we used our simple rules to qualify those patterns.

Now crude is trading much sloppier at 1030am and we need to find the HIGHEST PERCENTAGE LOCATIONS where our next trades will be.

The highest % trades will likely be at the highs and the lows of this trading range (price wedge)

As price rises im selling the highs of the wedge and the range highs at 86.05

I can also sell at resistance levels on my 34range chart, however, we know these levels on 89range are most important.

As price falls im doing much of the same, except buying at the lows of the wedge and the lows of the range.

Buying around 83.75 and 83.40 support level.