October 4, 2011

- in Uncategorized by schooloftrade

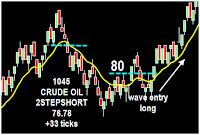

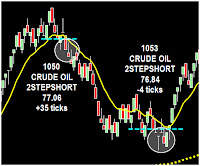

Don’t just sit there…short this! Day trading Crude Oil, Mini-Russell & Euro futures

We begin our day this morning with Gold futures in the middle of its range, crude oil futures trading outside the range, and the euro currency futures trading outside.

We will skip gold futures for the time being until it moves to the highs or lows, and focus our attention on the markets which have broken out of the previous day’s range.

Avoid the middles, trade the highs, the lows, and the breakouts.

855am EST

Euro currency futures are trading at the lows of a bear channel, so we need to beware trying to force trades short below the bear channel lows, and stay looking for the price reversal somewhere off these lows.

We used our Advanced Price Structures to find the legitimacy of the channel, and now we know we are ripe for a reversal.

The key today on the euro currency futures will be to wait for price to break above the resistance overhead of the bear channel at 1.3230.

Our three price structures on euro currency futures :

– Bear Price Channel

– Sideways Range at the lows

Outside day tells me to expect the breakouts, however, we are well-below the PLOD and our 2nd clue is the lows of the bear price channel will be a great spot for a reversal.

Sideways range at the lows tells me WHERE to look for the price reversal, above the resistance overhead.

If price rises I’m going to sell the resistance overhead at 1.3224 and 3230. If we break above those resistance levels I will then buy pullbacks because we are triggering the 2step long position off these lows.

As price keeps rising I will take profit at 1.3282 which is the next level of resistance, and then look at what price does from there. If price keeps going I will re-enter my long position with a pullback above 3282 and look to hold that position into the 1.3353 resistance.

If price falls I will buy support at 1.3142 the channel lows, and then if we keep making new lower lows I will be very careful not to over-trade short at the lows of the bear channel. As price drops I would rather be a buyer than a seller at the lows of a bear channel.

1130am EST

The market personality has definitely changed and the price action gets slower as we head into lunch.

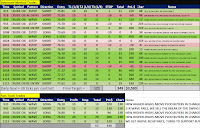

We’ve had 5 winning fast track trades today, everyone making their money, and we need to be careful not to give it all back.