- in Uncategorized by schooloftrade

Day Trading Morning Prep Gold, Crude Oil, Dollar Index, Euro, E-mini Russell Futures

Looking at the news this morning the spotlight is on crude oil futures. We heard reports overnight from OPEC that the world’s supply of crude oil is adequate, and we have crude oil inventories news at 1030am est today.

We will watch closely to see what the personality of crude oil looks like this morning, and try to wait for only the best time of the day to get involved.

Lets take a look at the markets we’re watching today…

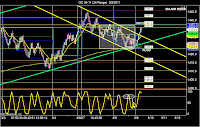

- Buy at support levels when price is dropping

- Sell at resistance levels when price is rising

- Price Wedge in yellow trend lines

- PHOD and PLOD

- Price CHannel in blue trend lines

- Price Channel in Green Trend Lines (major)

- Price Channel in Yellow trend lines (minor)

- PHOD and PLOD