March 7, 2011

- in Uncategorized by schooloftrade

Crude Oil Drops and we bought the lows before the POP

– We’re just getting started with another week in the live trade room

– Gold at new highs

– Crude Oil at new highs

– Euro new highs

– Russell trading inside the range from Friday

805am EST

– We don’t have any news to worry about this morning

– With the expectation of the US Market OPEN, we don’t have much to worry about

– Expect a slow start to a Monday without any news

– Pace of tape indicator shows me the speed is very slow at this time

810am EST

– We see the dollar is dropping, which gives us buying opportunities on the markets we trade most.

– As the dollar makes new lows, we can buy pullbacks on the crude, gold, euro, and Russell.

– Today, with the dollar dropping, the higher percentage trades will be LONG

– Dollar dropping = short term selling opportunities and long term buying opportunities

– Scalp the short side, and look to hold with the long side

815am est

– We see the speed of the tape is still quite slow

– Monday morning without any news, we somewhat expect that

– We see higher lows on the dollar index average true range, this gives us some hope that we will get a decent day out of this Monday morning.

– Lets stay patient and be ready for what this market has to offer us.

900am est

– We’re seeing a strong uptrend on the crude oil futures

– We want to buy at support levels as price rises, not buying into the highs, or with overbought momentum

– The most challenging aspect to a trending market is just knowing where the best place is to get in.

– Most professionals will wait for a pullback on a trending upside market, or wait for a retracement on a falling market.

930am est

– We tried to buy the lows on the crude oil channel, but the price action and the overhead resistance did not make it possible.

– Then we tried to sell the break of the lows, but we got chopped up b/c of a poor trade decision on Joe’s part, getting us in at the lows of the channel and the BMT and trend line support in our way

– We took our first trade as a loss on the Fast track, it was a bad trade decision

– We then waited for new lows to be made, and took our 2nd trade on the fast track for a winner, buying the lows.

– 2nd trade happened quite quickly, so we had to be on our toes

– New lower lows, with oversold momentum, will ALWAYS be a great buying opportunity.

– We have 1 winner on the advanced method for 20 ticks

– We are breakeven on the fast track method

– Speed has been very slow this morning

– The dollar is setting up for a wave short

– Lets look for buying opportunities on the markets we trade most.

1037am est

– Price action is very sluggish right now

– All the markets we’re trading are around the BMT

– We know the news is few this morning

– We know the speed and the ATR have both been very slow.

1100am est

– We see the crude oil futures trading in a wedge pattern on the 34range chart

– We want to sell the highs of the wedge, buy the lows of the wedge.

1110am est

– Gold futures and crude oil futures both showing slower speed

– Both showing narrowing price action

– Both showing wedge patterns on the slower timeframes

– Gold looks really tough, we see flat trigger lines across all timeframes

– All the trigger lines are also the SAME PRICE

– This means that gold is flat, and has been flat for a very long time.

1155am est

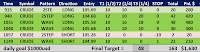

– We finished our day with 4 winners in a row on the FT method

– We hit our daily goal for the 6th day in a row

– We had to work through the Euro loss

– We had to work through the poor trade decision for the first trade fo the day

– And we also took a bad trade @ 925am est for a loss

– If you remove the POOR decisions these are almost all winners

– 1 loss on euro, everything else were winning trades.